[ad_1]

Receive free Apollo Global Management LLC updates

We’ll send you a myFT Daily Digest email rounding up the latest Apollo Global Management LLC news every morning.

Many rivals of Apollo Global Management were convinced that its merger with Athene Holding, its retirement annuities affiliate, would prove a strategic blunder.

The risk was that the private equity firm would spoil its high-margin, capital-light business of collecting hefty asset management fees by taking on a heavily regulated, lumbering balance sheet of a life insurance company.

Yet two years on, Apollo’s stock price is trading at an all-time high as its assets under management have soared to $600bn, an apparent vindication of the single, integrated company.

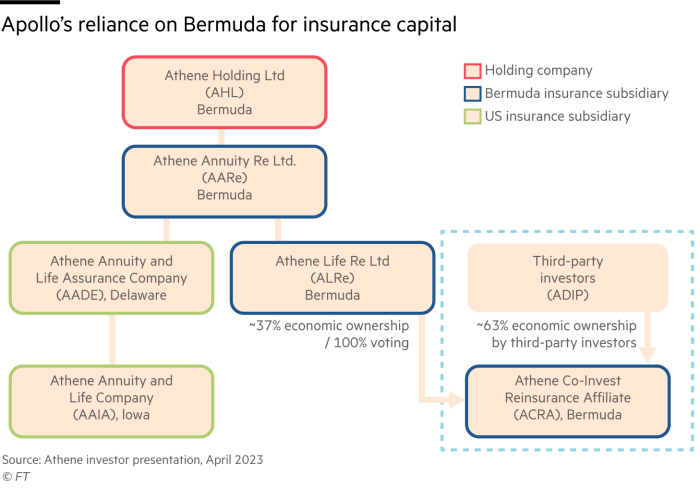

As it turns out, the Apollo/Athene combination has proved much more deft than it may appear. Using financial engineering, Apollo created an off-balance sheet gizmo based in the welcoming climes of Bermuda. The result is cheaper equity capital that has turbocharged Athene’s asset growth and, in turn, juiced Apollo shareholder returns.

Competitors in private equity as well as traditional insurers have noticed, replicating their own versions. And, increasingly, regulators and rating agencies are paying attention too. Moody’s wrote in a recent report that “the rising tide of offshore life reinsurance raises [a] yellow caution flag”.

For its part, Apollo notes that fresh investment in annuities and life insurance had been moribund for years — until it got involved. After creating Athene initially in a one-off 2009 reinsurance trade, Apollo went on to build enough of an annuities machine to take Athene public in 2016. Athene itself was conservatively capitalised with an A credit rating and billions in capital that exceeded regulatory requirements.

Apollo managed its investments well enough that Athene’s book value per share grew annually by an average of 17 per cent. Public shareholders, however, never fully embraced Athene, worried about its complexity and its tricky relationship with Apollo. As a result, its stock price never traded at a high premium to book value. The weak currency then left Athene hamstrung when it came to raising equity capital needed to buy or write more annuities.

As it turned out, Apollo’s longtime backers among sovereign wealth funds in the Middle East and other institutions liked Athene as a concept. But rather than buy Athene stock, Apollo invented in 2019 a so-called “sidecar” vehicle that functioned like a traditional private equity fund, calling capital only as needed, usually when Athene sought a big acquisition. The off-balance sheet fund pledged returns to its backers in the low teens, a cost of capital that was cheaper than what Athene’s then price/earnings ratio on its public stock implied.

The rub was the sidecar, known as ADIP, was domiciled in Bermuda. That home allowed ADIP’s fund investors to avoid corporate income tax, moderating their return requirements. Bermuda itself is central to Athene’s strategy and its original home before merging with US-based Apollo. Of its $24bn in total equity capital, $18bn is stationed in Bermuda entities.

Most of Athene’s annuity liabilities have migrated to Bermuda itself through reinsurance agreements. Apollo and Athene insist that the Bermuda activities have nothing to do with regulatory arbitrage. Rather, its capital ratios in the island nation are roughly the same as onshore in the US and that, ultimately, Apollo and Athene remain on the hook for customer obligations.

Apollo is also equally clear on the firepower that the billions in ADIP equity capital brings. A $1bn of Athene’s own equity stands up the acquisition and writing of $12bn of annuities. Adding in the sidecar equity as a supplement takes that figure up to $21bn, enough to be worth, all else equal, an incremental 25 per cent boost in fee income and investment earnings. More concretely, Athene forecasts the ADIP sidecar will help take its gross invested portfolio to $385bn by 2026, up from just $67bn a decade before, making it a “game changer” in the words of management.

Athene has just announced a second vintage ADIP vehicle with a $2bn fundraising, an apparent validation of its approach. It is notable that in insurance markets, illiquid and esoteric private capital somehow endures as a more efficient option than public capital.

Athene and Apollo had themselves merged, in large part, to eliminate the inherent principal/agent inefficiencies between an insurer and an affiliated asset manager. The sidecar structure has cleverly solved a cost of capital challenge. But it has also reintroduced this similar tension. With big gains for all sides, everyone is a winner for now. But the relationship is worth monitoring.

[ad_2]

Source link