[ad_1]

Receive free Admiral Group PLC updates

We’ll send you a myFT Daily Digest email rounding up the latest Admiral Group PLC news every morning.

Admiral Horatio Nelson’s advice was not to interrupt the opposition when they were committed to a mistake. British insurer Admiral has followed this strategy, avoiding the errors made by peers who took large losses on underpriced risks. Half-year results show profits rising and underwriting losses falling. The share price has been hoisted 8 per cent in response.

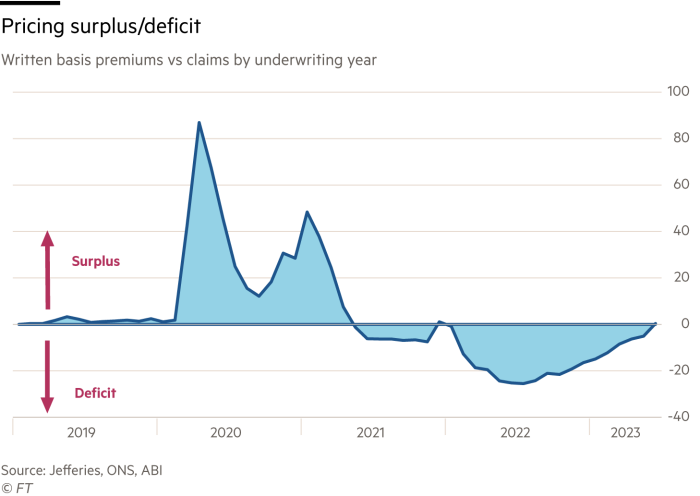

UK motor insurance has had a rough ride. Motor policy prices fell during the pandemic as cars remained stuck on driveways. Recovery in car trips coincided with rising repair costs. These ran ahead of premium increases, leaving the motor sector with record annual losses in 2022. Shareholders paid the price. Prior to results published on Wednesday, Admiral’s share price had lost almost a third of its value since the start of last year.

Rising premiums should lift share prices higher. Average UK motor premiums are now at record highs, according to the Association of British Insurers. At Admiral they rose 21 per cent year over year in the first six months of 2023. Compare this with the paltry 7 per cent increase in the previous six months, a figure well below the 10 per cent rate at which claims costs rose.

Admiral has traditionally led the wider motor insurance market on prices. Peer Direct Line may be about to report the same uplift in results due next month.

Claims costs have stabilised too, partly as a result of better supplies of parts and the slowdown in second-hand car price increases. But record UK wage growth in the quarter to June is reason for caution about inflation. This could have a detrimental impact on Admiral’s future claims costs.

The company’s interim payout dipped. Admiral shares should yield just over 5 per cent in 2024, according to Visible Alpha consensus. But better pricing should push up earnings more, predicts Tom Bateman at Berenberg. That could result in a yield closer to 6 per cent, a premium worth having.

Our popular newsletter for premium subscribers is published twice weekly. On Wednesday we analyse a hot topic from a world financial centre. On Friday we dissect the week’s big themes. Please sign up here.

[ad_2]

Source link